- Home

- Running your business

- Supporting statement

Supporting statement

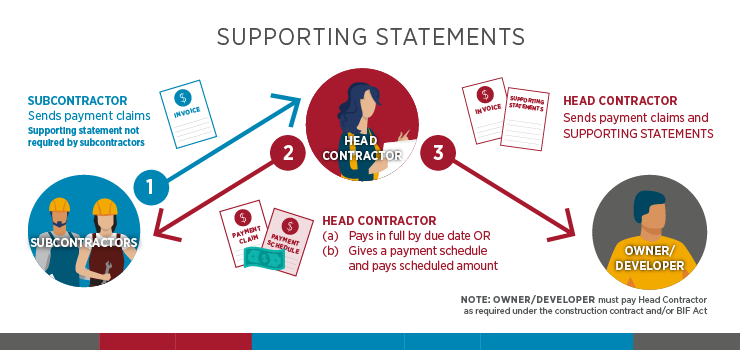

From 1 October 2020 new building industry laws require some claimants (that is, head contractors for non-residential construction contracts) to submit a supporting statement with any request for payment (payment claim) to a principal or developer.

What is a supporting statement?

A supporting statement is a written statement that tells the principal or developer if all subcontractors of the head contractor have been paid, or what is owed to them if there are outstanding payments.

For each subcontractor who has not been paid, the supporting statement must provide information about the unpaid amounts and reasons the amount has not been paid. It must state:

- the name of the subcontractor who has not been paid

- the amount still unpaid

- details of the unpaid payment claim (e.g. the invoice of payment claim number)

- the date the subcontractor carried out the work

- reasons the amount was not paid.

When are supporting statements required?

A supporting statement must be given with every payment claim in relation relating to the construction contract. Supporting statements are not required for residential contracts with a homeowner.

Only the head contractor who is contracted directly by the owner or developer needs to give a supporting statement AND ONLY if they have engaged subcontractors under the construction contract.

Subcontractors and persons further down the contracting chain do not need to give a supporting statement.

Supporting statement format and templates

As the law does not require use of a specific template, you may choose to develop and use your own. Alternatively you can use one of templates developed by the QBCC.

You can choose either of the below options based on your needs. Both options below will allow you to meet the new supporting statement requirements.

Option 1: Separate standalone attachment to your payment claim

s75 supporting statement template—option 1 (Doc 30KB)

See: Example s75 Supporting statement—option 1 (PDF, 136KB)

This is the best option if you need to state information about unpaid subcontractor payments. Once complete, you will need to provide both:

- the completed s75—Supporting statement

- your regular payment claim / invoice.

Option 2: Text included on your existing payment claim

s75 supporting statement template—option 2 (Doc 30KB)

See: Example s75 Supporting statement—option 2 (PDF, 114KB)

This option should only be used if you have paid all your subcontractors in full the amounts due and owing as at the statement date as it does not allow for details of unpaid amounts to be listed.

If you wish you can cut and paste the suggested wording into your regular payment claim / invoice.

Consequence for not submitting a supporting statement

Failure to provide a supporting statement with a payment claim as required may attract a penalty of up to 100 penalty units for head contractors.

In addition, head contractors who provide false or misleading information in a supporting statement may attract a penalty of up to 100 penalty units. Failure to provide a supporting statement with a payment claim as required may attract a penalty of up to 100 penalty units for head contractors.

Not including a supporting statement with the payment claim DOES NOT make the payment claim or invoice invalid.

If a head contractor fails to provide a supporting statement with their payment claim, the respondent (e.g. principal) receiving the payment claim should still take all necessary steps to ensure they respond to the claim as required by the BIF Act (that is, providing a payment schedule or paying in full by the due date).

Haven't received a supporting statement?

You can notify the QBCC that a supporting statement was not supplied when required.

Frequently asked questions

For more information, see the questions and answers below about supporting statements.

Construction contracts

A ‘construction contract’ is a contract to carry out construction work or to supply related goods and services to another party. This can include a person carrying out domestic building work – but only:

- if the client is a company, trust, owner builder or building contractor,

- to the extent the client will not reside or does not intend to reside in the building.

Where the construction work to be carried out or related goods and services to be supplied is not domestic building work, the contract will likely be a construction contract. For example, work that is excluded from the definition of domestic building work, such as architectural design work, preparing drawings, a soil report, or obtaining building approvals.

IN SUMMARY: The requirement to give a supporting statement does NOT apply to construction contracts for carrying out domestic building work where the client is a resident owner.

Subcontracts

A contract under a head construction contract will be a ‘subcontract’ so long as all or part of it, contributes to the performance of the construction work or supply of related goods and services under the head construction contract, and is not merely coincidental.

Here are some examples:

- buying general materials that a head contractor requires for the operation of their business from a wholesaler – is not a subcontract

- buying hammers and work boots under a line of credit with a retailer – is not a subcontract

- buying bathroom modules in bulk and not purchasing them to contribute to the performance of a particular contract – is not a subcontract

- buying a special tool required to install 20 bathroom modules for a particular construction contract – is a subcontract.

Amounts owed to claimants under a subcontract as explained above – are covered by the supporting statement declaration requirements.

A supporting statement must declare that all subcontractors have been paid what is ‘owed’ to them, including amounts resulting from payment claims.

Other amounts owing, such as from an adjudication decision, final and binding decision from a dispute resolution process or an amount ordered by a court, are not required to be disclosed on the supporting statement. However, if an unpaid payment claim amount becomes the subject of an adjudication application or court proceeding it continues to be an amount owed until the adjudicator or other body decides the amount is not owed.

For the purpose of completing a supporting statement, an amount is considered owed to a subcontractor only once the due date for payment has occurred.

When an amount is ‘owed’

If the due date for the amount required to be paid to a subcontractor is before the date the supporting statement is given, it is an owed amount.

If all subcontractors have been paid amounts owed to them by the due date your supporting statement simply needs to declare that to be the case. You do not need to provide details of the owed amounts you have fully and correctly paid.

See below for what you need to do in relation to ‘unpaid’ or overdue amounts.

When an amount is not yet ‘owed’

If the due date for the amount required to be paid to a subcontractor is the same day, or a date after, the day the supporting statement is given, the amount is not yet an 'owed’ amount.

These amounts become ‘owed’ on the due date for payment, and are not the subject of the declaration made in the supporting statement (they will be covered in any later supporting statements)

For information on how to calculate the due date for payment, read about how the requirements when requesting payment.

If at the time of giving the supporting statement, there are one or more subcontractors who have not been paid amounts owed to them in full by the due date the supporting statement must provide the following details for each subcontractor:

- the name of the subcontractor who has not been paid

- the unpaid amount owing to them

- details of their unpaid payment claim (e.g. the invoice or payment claim number)

- the date the subcontractor carried out the work or supplied the goods or services

- the reasons the amount was not paid.

For examples and guidance on when to include the details of unpaid amounts to subcontractors download: